ZERO Hidden Fees

Honest! No sneaky stuff!

Transparent Pricing

A rarity in this industry.

GET A FREE QUOTE

NO Contract Plans

Contract-Free Options.

Please Login

To access your account dashboard.

FREE EQUIPMENT

Get a FREE Card Reader!

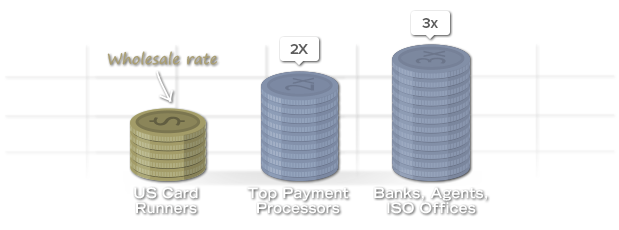

How Exactly Can We Save You Up To 40%???

Simple… We remove all of the extra costs. People with their hands out, overhead, fees, etc.

Mobile Readers

Mobile readers come in handy when you need to process payments on the go. Turn your iPhone or Android device into a handheld terminal with our simple attachment devices. Our mobile terminals are EMV as well for optimal security.

Ecommerce Solutions

Retail EMV Card Readers

Our plug-n-play devices are all EMV capable/PCI compliant and work right out of the box. To top it off, we have all of the newest tech to allow for contactless pay, apple/android/google wallet payments, chip readers, etc.

Payment Gateway

Completely secure solutions for processing your customers credit cards via your website. Safely store cards, set up repeat payments, and take advantage of our relationships with partners like Authorize.net to save more than going direct.

Point of Sales Systems

We can provide a POS system for any need you may have. Whether you are a restaurant with very specific needs or a retail location looking for a simple and inexpensive solution, we can use our buying power to get it for you cheaper.

Quickbooks Plugins

You already use Quickbooks and love it, well now we can integrate our processing power, speed, and significantly better prices into their system. Send out invoices with links to pay but at a fraction of the cost QB’s charges for that service.

Best Support in The Biz!

Dedicated Sales Representative

To ensure the type of support you deserve, you will have a representative assigned to you that will always be your account representative. This way you will get to know this person and feel comfortable establishing an open communication line for any and all support needs. This person’s success with our company depends the quality of care they provide for all of their assigned customers. Bad marks or reviews are not tolerated, so if for whatever reason you are unhappy with your representative, simply inform us and you will have a new one assigned immediately. Our goal is 100% geared around making sure our customers are happy with our services at all times. From pricing to tech support, we’ve got you covered.

24/7 US Based Support

24 hours a day, every single day of the week (including holidays) there is someone waiting to take your call. No annoying phone systems or call center reps that barely speak English. Our support staff is highly trained and dedicated to 100% satisfaction of our customers. How can a smaller sized business, with self-admitted “lower overhead” manage a feat like this? Because, when you call our Support line you speak to someone at TransFirst (the company our agency sells on behalf of) directly. Because you are also a customer of theirs, they will be able to pull up all of your information and make adjustments on our behalf just as if you were speaking to your dedicated support representative. 100% supported, 100% of the time.

Our 24/7 support line is available to US Card Runner’s members only.

For any pre-sale questions call our sales line – (800) 785-3157

Retail

- $5 per Month

- FREE EMV Terminal

- Same Day Approvals

- Next Day Deposits

Mobile

- $5 per Month

- FREE Mobile EMV Card Reader

- Same Day Approvals

- Next Day Deposits

- iPhone & Android Compatible

Keyed In

- $9.95 per Month

- FREE Gateway

- Same Day Approvals

- Next Day Deposits

Frequently Asked Questions

Why choose US Card Runners over Square, PayPal, Quickbooks, Chase Paymentech, etc.?

Square – Square is becoming more and more popular everyday. Yet, we can crush their pricing and give better support, equipment, and all around experience. Aside from their excellent marketing campaigns, they are no match for us.

PayPal – Again, we crush their pricing and Paypal processing always sides with the user in disputes. Not the type of partner you want, when they won’t have your back if an issue were to arise. PayPal’s big pull is their trusted name, but it comes at an expense that is flat out not worth it.

Quickbooks – 95% of the time we crush their pricing too. Quickbooks can custom quote and sometimes wind up in the ballpark, but rarely ever do this. And besides, the main reason people choose Quickbooks is because they are already using Quickbooks software for their accounting and want the convenience of being able to have payments linked to their account. And to be able to send invoices with links to click and pay (they charge more for this BTW). But, we are Quickbooks compatible and and link into their software using a plugin for a one time fee (versus their monthly expense for this feature).

Chase Paymentech – Chase Paymentech’s big thing is that they deposit the funds next day. So do we. And they have better pricing than majority of the other major providers out there. So do we. But ours is a good bit better. Other than that, Chase does not actually do the processing themselves, they simply back the money. Sounds nice, but call in to get some help if an issue were to arise and see how well that goes. Chase does not actually support this themselves, since this is outsourced to a different company. The convenience of banking and processing with the same company is lost, but they do not like you to know that.

Why Us Over Any of The Others?

TRUST. TRANSPARENCY. HONESTY.

The owner of the company started the company for a lack of the 3 principles above in a majority of the merchant services providers he had dealt with when on the customer end. Hidden fees, “Yes-men” telling you whatever you want to hear to close the deal, fine print in contracts that give you a raw deal, and bold faced lies are common place in this industry when dealing with agents/agencies that lack scruples. This was the foundation upon which this company was built. He vowed to offer a honest and straight-forward option for customers to choose from. And along the way established a relationship with one of the largest and most respected processors in the industry giving him the ability to offer some the industries best pricing as well. With a combination of this trust-worthy and transparent approach mixed with some of the best prices available US Card Runners quickly became a no-brainer choice for many Americans looking for just that. See what makes us different for yourself. Start saving money with us today!

How much can you actually save me?

What is "Interchange"?

Interchange rates change depending on the type of card that you use. Interchange rates are different between Visa, MasterCard, Discover, AMEX, etc. But they also differ based on what type of Visa (for example) you may be using. A Visa debit card has a significantly lower fee than an AMEX corporate card. There is more risk in a corporate card than there is in a personal debit card, as a company is more likely to dispute a charge that could cost the bank money. Therefor they charge a higher rate for using those types of cards.

Why don't we charge a flat rate fee like other companies?

Company A (let’s call them Rectangle) charges a flat rate fee of 2.75% for swiped cards. It’s a flat rate of 3.5% + $0.15 for keyed in transactions. They had a great day and processed 100 $200 orders for a total of $20,000, of which 50 were keyed in and 50 were swiped. If you do the math, the keyed in orders cost you $380 and the swiped orders cost you $275 for a total of $655 in processing fees.

Company B (let’s call them US Card Runners) charges interchange + for the same orders. Let’s imagine that 50 users used a Visa debit card and 50 used a Visa corporate card. The 50 debit card users would come in with an interchange rate of 0.05% + $0.21. That means the 50 debit cards cost (0.25% + $0.10) + (0.05% + $0.21) = 0.3% + $0.31. That cost is a total of $45.50 (versus $275). Now, it is true that we’ve tacked on $0.31 in transaction fees, but we’ve also reduced the percentage by 2.44%!!! Now, the other 50 orders used a corporate Visa and it’s rate was processed at a VERY high 2.5% + $0.10. Add our fees of (0.25% + $0.10) + (2.5% + $0.10) = 2.75% + $.20. That cost is a total of $285 (versus $380). If you add both the keyed ordered and swiped orders you get a total of $330.50 in processing fees.

The difference between processing credit cards with Rectangle (using a Flat Rate Fee) and US Card Runners (using Interchange + system) is $324.50. Imagine if this savings was multiplied across the rest of the month. You could be looking at saving your business close to $10,000/month in processing fees! That’s a bottom line that can’t be argued with.

How soon are funds deposited?

What about my equipment?

What types of businesses does US Card Runners accept?

How do I get started?

Our application takes less than 5 minutes to fill out with a representative and approval time is typically a little over an hour. Once you are approved you will receive an email with your new terminal’s tracking number which will show your terminal has been shipped and will be delivered within 24 hours.

The best way to get a formal quote created for you is to send us a copy of your latest statement. We can custom quote your business giving you a side by side comparison of how much money you could be saving by switching to US Card Runners.

Additional Questions

Can I use a smartphone or tablet to process credit cards?

Do I need a business license, Tax ID, or Resale Certificate to obtain a merchant account?

Do I need a business checking account to obtain a merchant account?

What if I have less than perfect credit (or plain old bad credit)?

How long does the approval process take?

Sounds great! How do I get started?

If you are not currently accepting credit cards, simply notate that in the quote request and we will get you taken care of right away! Looking forward to getting you onboard!

U.S. Card Runners processes using the processing power of TSYS® and TransFirst®, both of which have an A+ BBB rating.

U.S. Card Runners is a registered MSP of: Wells Fargo Bank. © 2016 U.S. Card Runners. All rights reserved worldwide.

U.S. Card Runners processes using the processing power of TSYS® and TransFirst®, both of which have an A+ BBB rating.

U.S. Card Runners is a registered MSP of: Wells Fargo Bank. © 2016 U.S. Card Runners. All rights reserved worldwide.